Article Index

Related Articles

Despite several firms citing headwinds in demand, 2023 was not without its bright spots for flexible packaging converters.

Sonoco reported achieving record results in Operating Profit and Adjusted EBITDA in its flexible packaging segment in Fiscal Year 2023.

TC Transcontinental managed to hold revenues essentially flat at $2.94 billion (down just 0.5% versus 2022) and, in the fourth quarter, the company increased its adjusted operating earnings before depreciation and amortization by 3.1% year on year, despite lower revenues.

Winpak noted that the “worldwide low industrial activity resulted in a significant price reduction to raw materials for most key components of Winpak products, which is beneficial to the Company and its indexed clients through lower prices. Overall, the gross profit margins improved by 1.2 percentage points over 2022 to reach 29.3 percent.”

Meanwhile, the consolidation that has been underway in the flexible packaging industry is evident in this year’s list of Top 25 converters.

For example, SIG in mid-2022 completed its acquisition of Scholle IPN, putting SIG in this year’s Top 25 list in lieu of Scholle.

And while Sonoco would have made the Top 25 list regardless of its acquisition of Inapel Embalagens Ltda. in Brazil in late 2023, that acquisition and others are indicative of the continuing consolidation taking place in the flexible packaging sector.

Thomas Blaige, founder of Blaige Industry Analytics LLC, offered a few observations on this year’s Top 25 list within the context of consolidation:

- In the top 25, there are nine independents, 10 global+public and six Private Equity-owned firms, so a total of 16 of the top 25 represent large organizations with significant access to resources.

- The 2023 rankings list is representative of the great consolidation trend in the fragmented flexible packaging market (see Blaige’s Flexible Packaging Converters are Hot Commodities report).

- As the large-cap participants have largely consolidated, the small- to mid-cap participants are becoming the focus (buyers moving downstream, bidding up middle market multiples).

Focus on Sustainability

Alison Keane, President and CEO of the Flexible Packaging Association, notes that “sustainability remains top of mind for these converters, with emerging technologies and materials being key. Converters are all chasing the ultimate sustainability solutions for their customers.”

Keane adds: “This means circular solutions, like mono-materials for more readily recyclable packaging that provide the same or similar barrier protection for food and health applications. It also means compostable options, both home and industrial; but also, recyclable options, such that composability only comes into play if the package leaks into the environment.”

Finally, Keane notes, incorporation of post-consumer recycled content (PCR) is high on the list of priorities.

“Solutions exist, for both mechanical and chemically recycled PCR, but adoption thus far by brands has been slow,” Keane said.

We present here just a few examples of recent initiatives on the part of flexible packaging converters to provide more sustainable packaging.

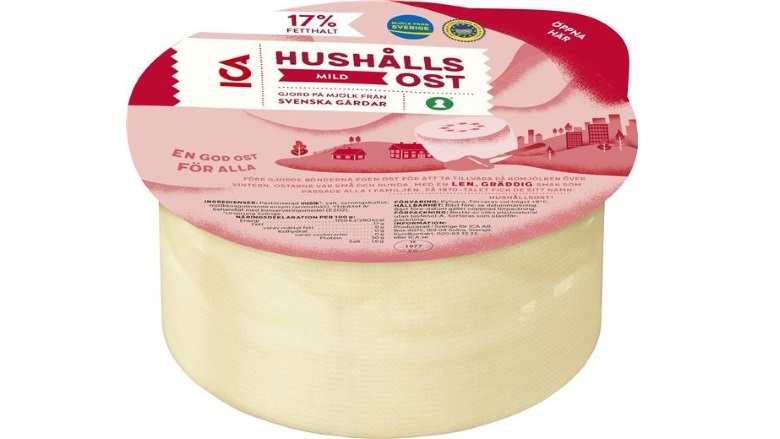

In November 2023, Mondi announced its collaboration with Skånemejerier to create a mono-material, polypropylene (PP) based packaging for, among others, ICA’s Hushållsost cheese.

In November 2023, Mondi announced its collaboration with Skånemejerier to create a mono-material, polypropylene (PP) based packaging for, among others, ICA’s Hushållsost cheese. In February, American Packaging Corporation announced the commercial launch of another RE™ Design for Recycle flexible packaging technology targeted at frozen food products such as frozen fruits and vegetables. This new technology joins a portfolio of packaging technologies in APC's RE™ sustainable packaging portfolio, that also includes Design for Compost, Circular Content, and Renewable Content, as well as several Design for Recycle options.

In February, American Packaging Corporation announced the commercial launch of another RE™ Design for Recycle flexible packaging technology targeted at frozen food products such as frozen fruits and vegetables. This new technology joins a portfolio of packaging technologies in APC's RE™ sustainable packaging portfolio, that also includes Design for Compost, Circular Content, and Renewable Content, as well as several Design for Recycle options. In alignment with Inteplast Group’s sustainability goals, the BOPP Films business unit has received ISCC (International Sustainability & Carbon Certification) PLUS certification at the following facilities: Gray Court, South Carolina; Lolita, Texas; and Morristown, Tennessee.

In alignment with Inteplast Group’s sustainability goals, the BOPP Films business unit has received ISCC (International Sustainability & Carbon Certification) PLUS certification at the following facilities: Gray Court, South Carolina; Lolita, Texas; and Morristown, Tennessee. Accredo Packaging, a leader in its diverse offering of more sustainable packaging solutions, foresees continued development of robust sustainability goals for its North American operations, with key milestones targeted to be achieved by 2025.

Accredo Packaging, a leader in its diverse offering of more sustainable packaging solutions, foresees continued development of robust sustainability goals for its North American operations, with key milestones targeted to be achieved by 2025. Amcor announced in late 2023 its collaboration with the French family-owned cheese producer, Fromagerie Milleret, to launch a new recycle-ready paper packaging for the company’s Le Baron Brie and l’Ortolan Bio premium cheeses.

Amcor announced in late 2023 its collaboration with the French family-owned cheese producer, Fromagerie Milleret, to launch a new recycle-ready paper packaging for the company’s Le Baron Brie and l’Ortolan Bio premium cheeses.